by Willie Tan | Jul 21, 2025 | News

Singapore’s prime retail property sector continues to demonstrate remarkable strength, with average gross rents climbing 3% year-on-year. A new report from real estate consultancy Knight Frank reveals that the market is thriving despite broader economic pressures. The “Singapore Retail Market Update – Q2 2025” shows a consistent upward trend, giving investors and landlords reason for optimism.

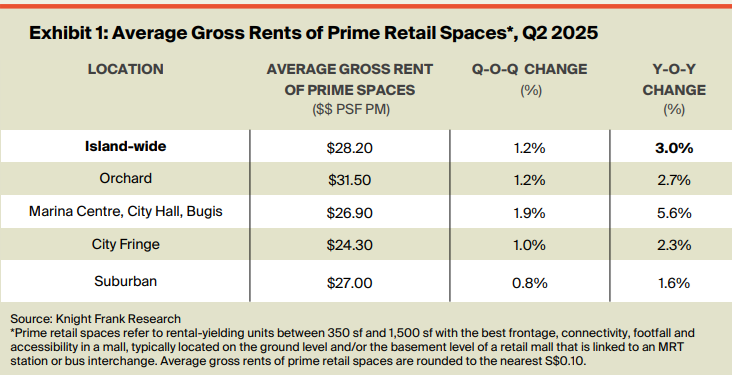

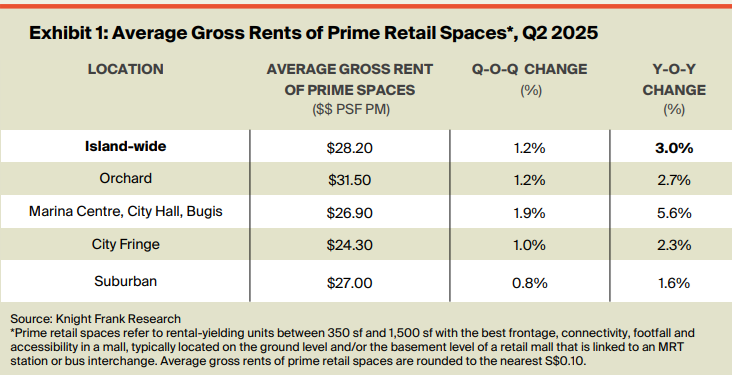

According to the research, the average gross rent for prime retail spaces across the island now stands at S$28.20 per square foot per month. This figure also represents a healthy 1.2% increase compared to the previous quarter. For clarity, the report defines these prime units as spaces between 350 and 1,500 square feet that boast the best frontage, connectivity, and footfall within a mall. Typically, these are located on the ground or basement levels with direct links to MRT stations or bus interchanges, ensuring maximum consumer traffic. This sustained growth underscores the enduring appeal of premium physical retail locations.

City Centre Hotspots Lead the Charge in Rental Growth

While the island-wide average shows solid growth, a detailed look reveals that specific central locations are significantly outperforming the rest of the market. The area encompassing Marina Centre, City Hall, and Bugis reported the most substantial increase. Rents in this popular precinct surged by an impressive 5.6% since the same time last year, jumping 1.9% in the last quarter alone. The average gross rent here has now reached S$26.90 per square foot per month. This highlights strong demand for centrally located malls with a vibrant mix of office crowds, tourists, and local shoppers.

In contrast, suburban malls saw the most modest annual rental increase at just 0.8%, although their average rent remains competitive at S$27 per square foot.

Unsurprisingly, the Orchard Road area continues to command the highest rents in the nation.Prime spaces along the iconic shopping belt fetch an average of S$31.50 per square foot per month, cementing its status as Singapore’s premier retail destination. This data provides clear insights for investors looking to target areas with the highest growth potential and rental yields.

A Look Ahead: Can a Supply Boom Stabilise Rising Rents?

The steady increase in gross rent, however, presents a significant challenge for tenants. Retail businesses, particularly in the food and beverage (F&B) sector, are already grappling with high operating expenses. The Knight Frank report notes that operating expenditures for F&B businesses have reached a record high of S$12.3 billion, and rising rents could further erode their margins. The resilience of these businesses will be a key factor to watch in the coming months. This dynamic underscores the delicate balance between landlord profitability and tenant sustainability.

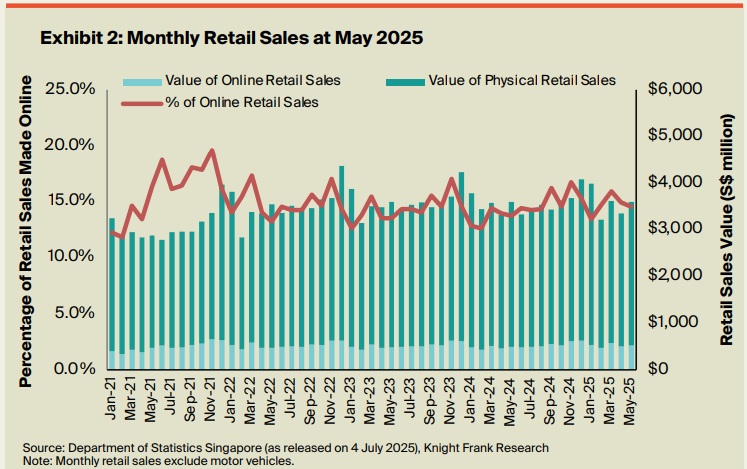

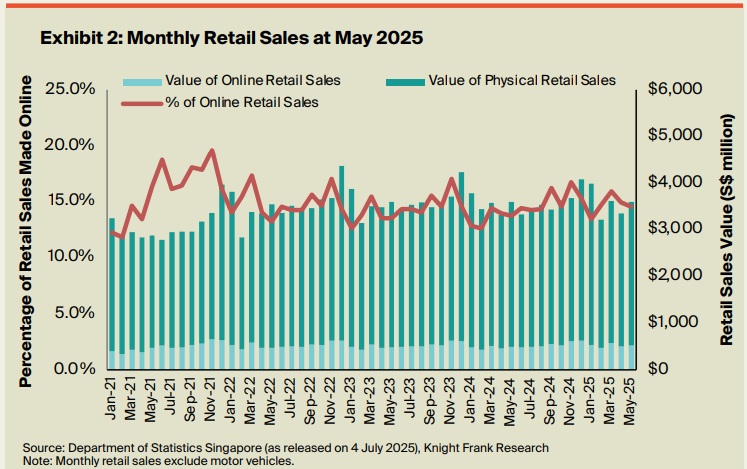

Fortunately, a silver lining appears on the horizon. The report projects that rental prices are likely to stabilize and potentially even decrease in the medium term. Between 2025 and 2029, a substantial 4.3 million square feet of new gross retail floor area is scheduled to enter the market. This significant increase in supply is expected to ease the upward pressure on rents, helping to normalize lease values and provide tenants with more options. For investors and developers, this signals a more competitive landscape ahead, while for businesses, it may offer much-needed relief. Despite the rise of e-commerce, this report reaffirms that physical retail remains a powerful force, contributing to over 85% of all retail sales in Singapore.

Source: The Daily Scan

by Willie Tan | Jun 12, 2025 | News, Property Trends

Singapore’s vibrant retail landscape is currently navigating a period of significant adjustment as vacancy rates show a noticeable increase. Recent government data highlights that the islandwide retail vacancy rate climbed to 6.8 per cent in the first quarter of 2025. This figure represents a clear uptick from the 6.2 per cent recorded in the previous quarter. This consequently signals a shift in market dynamics. This trend is primarily driven by a slowdown in the net take-up of spaces. This has been compounded by the introduction of a fresh supply into the market. Therefore, both landlords and tenants must understand the underlying causes and future outlook to make informed decisions.

The Driving Forces Behind Rising Vacancies and Tenant Exits

Several converging factors are contributing to the challenging environment that is prompting more retailers to reconsider their physical footprint. Firstly, a prolonged slowdown across the retail and dining sectors has put sustained pressure on businesses. This economic reality is exacerbated by relentless cost pressures, including a persistent labour crunch, which retailers are struggling to absorb. Consequently, their inability to fully pass on these rising costs to consumers is resulting in painfully squeezed profit margins.

Furthermore, consumer behaviour has shifted, with shoppers becoming more cautious and cutting back on discretionary spending. This is evidenced by a drop in retail sales during February and March 2025, following a promising start to the year. In addition, the marketplace has become fiercely competitive, particularly within the Food and Beverage (F&B) sector. Some industry reports suggest the F&B scene is at risk of oversupply, leading to a cycle of rapid expansion followed by equally swift closures, which ultimately results in wasted capital and resources.

The Retail Tenant’s Dilemma: High Rents and Lease Negotiations

Unsustainable rental rates remain a critical pain point for many businesses, affecting even those in traditionally high-traffic locations. Tenants in less populated areas or developments with low footfall are understandably the most pronounced casualties of this pressure. As a result, many tenants are actively seeking to pre-terminate their leases, a clear indicator of market distress. This option, however, comes with stringent conditions that require careful consideration before any action is taken.

Typically, early lease termination requires at least six months’ notice or a significant payment equivalent to six months’ gross rent. Landlords also often require additional compensation equal to the security deposit, making it a costly exit strategy for struggling businesses. For tenants whose lease contracts do not permit early termination, the focus shifts towards negotiation. These discussions may involve requesting a rent reduction, proposing a restructured payment plan, or finding a suitable replacement tenant. These alternatives require the landlord’s explicit approval.

A Tale of Two Markets: Prime Resilience Amidst General Weakness

Despite the overall increase in vacancy, the market is not uniform, revealing a fascinating and complex picture. In the first quarter, net demand for retail spaces was a negative 129,000 square feet, starkly reversing five consecutive quarters of positive take-up. Simultaneously, about 323,000 square feet of new retail space came on stream, which new entrants absorbed, preventing an even sharper spike in vacancy.

However, a key paradox has emerged where average rents have largely held steady, particularly in prime locations. Rents in the coveted Orchard Road and suburban areas remained flat at S$23.20 per square foot (psf) and S$14.70 psf, respectively. Malls in prime districts continue to demonstrate remarkable resilience, supported by a limited supply of available space. This scarcity empowers landlords to negotiate higher rents and maintain healthy momentum for lease renewals, especially with enduring luxury retailers.

A crucial metric for understanding this resilience is the occupancy cost, which measures rent as a proportion of tenant sales. For major mall operators like CapitaLand and Frasers, occupancy costs remained sustainable below 20 per cent in 2024. This suggests that for well-positioned tenants, revenues are still growing at a pace that justifies the rental costs, showcasing a clear divergence between prime and secondary retail spaces.

Future Retail Outlook: Short-Term Stability Before a Supply Wave

Looking ahead, the market is expected to experience increased tenant churn throughout the remainder of the year. Underperforming retailers may choose to exit early or simply not renew their leases upon expiration. While new store openings have historically outpaced closures, there is a growing expectation that this trend could soon reverse. This follows a challenging 2024 where store closures hit a 19-year high, indicating deep-seated structural shifts.

In the short term, rental rates and occupancy levels are likely to remain supported over the next two years. This stability is largely due to a relatively limited pipeline of new retail supply, with under 400,000 square feet of net lettable area expected annually. However, a significant wave of new supply is looming on the horizon from 2028 onwards. This future influx, led by major developments like the Marina Bay Sands expansion, will introduce over 1.2 million square feet of space, potentially reshaping the competitive landscape once more.

For now, industry experts anticipate that Orchard Road rents will likely perform at the upper end of the forecasted 1 to 2 per cent growth range for this year. Conversely, suburban rents are expected to track the lower end of that projection, reflecting the ongoing bifurcation of the market.

Source: Business Times