My review of One Marina Gardens by the Kingsford Group

[This article was first posted on daryllum.com on 26 Mar 2025]

You know what I find perplexing? If location is key when it comes to property investment, then why are properties in the core central region getting so little interest from developers and buyers alike? Little when comparing the interest in places like Tampines. Buyers do realise that projects like Parktown Residences are located in Tampines and Tampines is located at the east end of Singapore yup? Was the pricing so impressively attractive that buyers needed to flood the showrooms? Yes it is an integrated development but why do buyers not consider something in the core central region as well?

The highly restrictive Additional Buyers’ Stamp Duties (ABSD) levied on foreign buyers has put the brakes on almost all foreign purchases. I have always maintained that if a foreigner chooses to pay the 60% ABSD, there is something that should be scrutinised. Imagine this, a foreigner purchases an SGD$5 million property. He pays SGD$3 million as ABSD. His total acquisition cost, including the usual Buyers’ Stamp Duty and other fees amount more than SGD$8 million. As a foreigner with more than SGD$8 million, he would have choices galore. He has access to properties all around the globe. If that individual can purchase properties from all over the world, what is his motivation to pay more than SGD$8 million for something that is perhaps valued at around SGD$5 million? This means that the moment he purchases the property, the asset that he is holding is worth much less than what he paid for. This, in investing sense, is purely illogical. However, if that individual acquired his monies relatively easily, then he would not mind losing that value. Foreign buyers are almost non-existent. In fact, if I were the authorities, I would question and scrutinise the very few purchases by foreigners. I would want to understand the motivation and purpose for such a purchase. Well, if there were no clear motivation for the buyer to purchase Singapore properties then it would be prudent to scrutinise his source of funds for the property purchase.

So then, foreign property purchases have slowed to a trickle. This perverts the normal demand for Singapore properties. Foreigners would be less motivated by things like familiarity and proximity to other family members. For example, if my family members and I have been living in a certain part of Singapore, say Toa Payoh, then if there is a new property launch in Toa Payoh, I would be more likely to be enticed to make a purchase because I want to live near my family members and also to live in a part of Singapore that I am familiar with. This is why, to me, properties like Chuan Park are selling well as compared to a property like Aurea. There are fewer existing families living around Aurea as compared to Chuan Park. Hence there will be less “familiar” buyers for Aurea. Go to Chuan Park and the typical buyer will be someone who lives or lived around the area. Or has family members living in the area.

Location, despite what we have always focused on, may not weigh as much on current buyers’ consideration in today’s market. Familiarity with a particular location is high on buyers’ consideration. This is why many developers look at marketing their projects to HDB upgraders. This can be seen in the weak bids for land in areas with less HDB upgraders. Let me turn you back to end 2024 where the Marina Gardens Crescent site drew just one bid of SGD$770.5 million, or SGD$984 per square foot per plot ratio (psf per) This bid was too low and URA did not award this site to the bidder. This bid is nearly 30% lower than the neighbouring Marina Gardens Lane site. This is the site on which One Marina Gardens is located on. This one Marina Gardens Lane site was awarded to the Kingsford Group in July 2023 for SGD$1.03 billion or SGD$1,402 psf ppr. Look around this area. There are no residential properties around the area. It is inconceivable that someone will walk into the One Marina Gardens sales gallery and say, “I lived in this area for the past few decades and would like to purchase a unit in this development due to my familiarity with the location”.

Details about the development

One Marina Gardens is a 99-year leasehold development. The total site area is 12,245.10 square meters. The development consists of 937 units spread across two blocks. The two blocks are 30 and 44 storeys. It will also have commercial units like 2 restaurants, 2 shop units and a childcare centre. There will be 445 carpark lots. The expected completion is in 2029.

Where is the development located?

One Marina Gardens is located along Marina Boulevard.

One Marina Gardens Location Map

It is located right next to exit 4 of Marina South MRT Station. Marina South MRT Station is one of the stations on the Thomson East Coast Line. Marina South MRT Station is not yet opened. It is scheduled to open in tandem with developments in this area. I believe that this means that when One Marina Gardens is completed, Marina South MRT Station will be operational. For the purposes of this review, we will refer to TE22 Gardens by the Bay MRT Station rather than TE21 Marina South MRT Station.

Travelling from Gardens by the Bay MRT station to Orchard MRT station would take a total of 13 minutes over 6 stations. The cost is $1.59.

Gardens by the Bay MRT to Orchard MRT

Travelling from Gardens by the Bay MRT station to Raffles Place MRT station would take a total of 5 minutes over 2 stations. The cost is $1.19.

Gardens by the Bay MRT to Raffles Place MRT

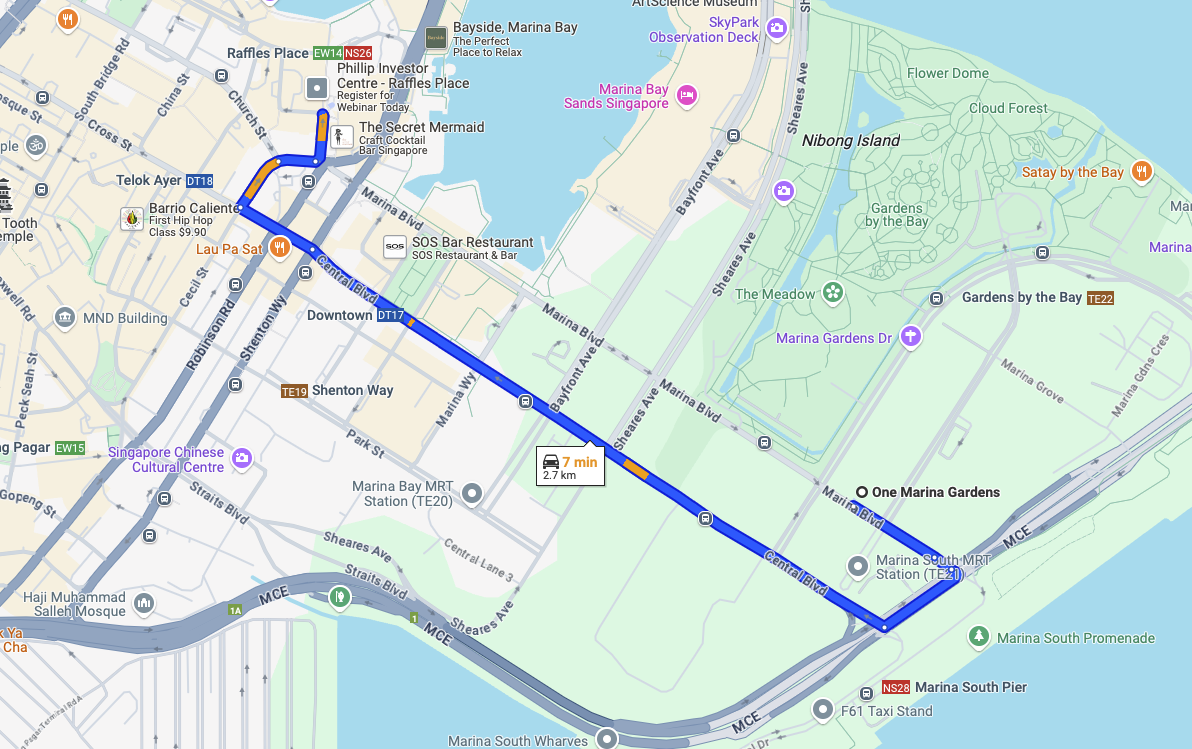

The drive from One Marina Gardens to Raffles Place would take approximately 7 minutes and the distance travelled is about 2.7 kilometres.

The drive from One Marina Gardens to Raffles Place

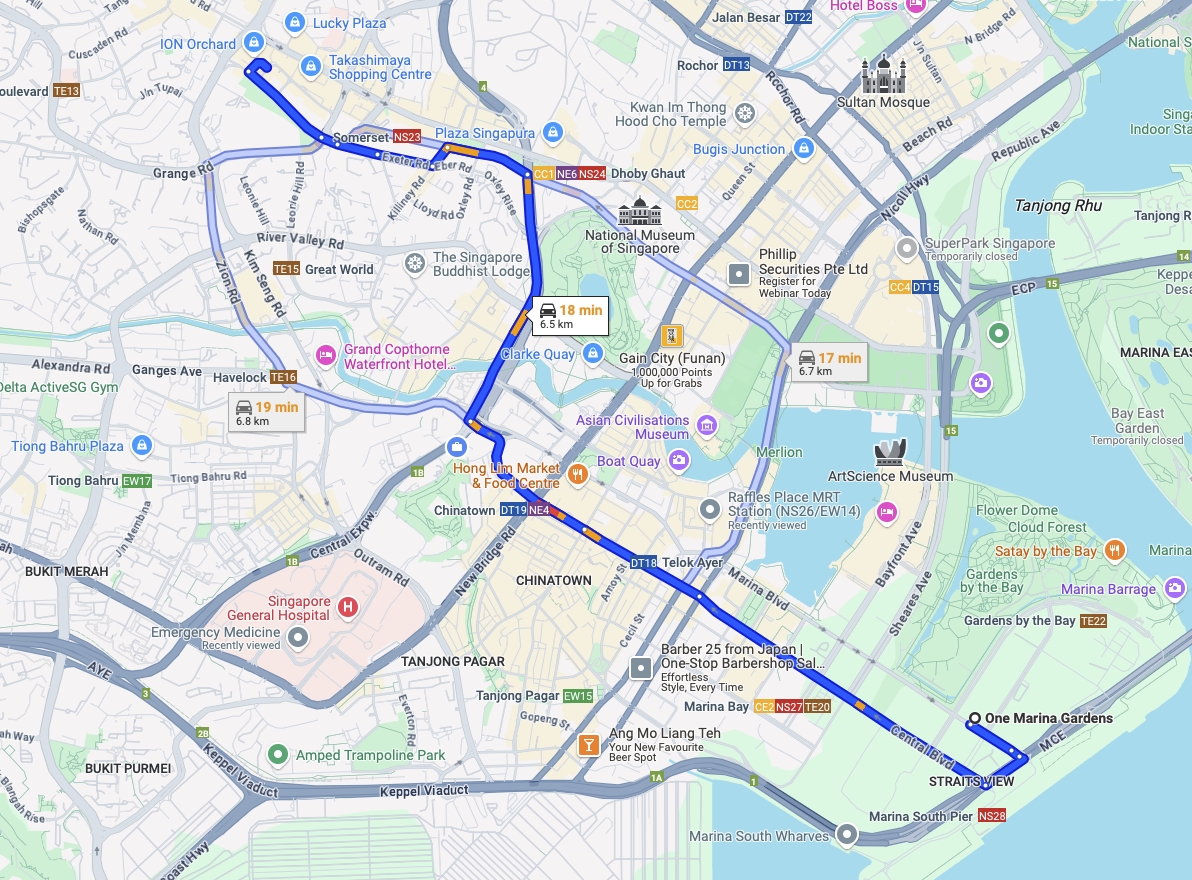

The drive from One Marina Gardens to Orchard Road would take approximately 18 minutes and the distance travelled is about 6.5 kilometres.

The drive from One Marina Gardens to Orchard Road

One Marina Gardens is located at the fringe of the Marina Bay Financial District. I do not think that residents would drive to Raffles Place. I believe the short train ride would be the most ideal option. As a point of reference, the Google Map query was done in the afternoon at about 4pm. Hence traffic is light. If you are driving during peak hours, do factor in additional travelling time.

Who is this development for?

I genuinely think that if you believe in the concept of catchment areas, then why are you not considering properties in and around the Marina Bay Financial District? Are your tenants not coming from people who work in offices in the area? If so, I do think that if you are looking to purchase for rent, then this is the ideal property for you. I am a person who always focuses on what is around the area. If the area is littered with offices with highly paid employees, then this is a huge plus.

One of the reasons I can offer as to why many Singaporeans do not think this way is because of the ABSD. On multiple properties, ABSD applies. Hence Singaporeans only have one property purchase which is not subject to ABSD. If so, that first property is likely to be a property in a location which they are familiar with. In certain cases where a married couple plans to have two private properties, one under the husband’s name and another one under the wife’s name, then this is an ideal second property.

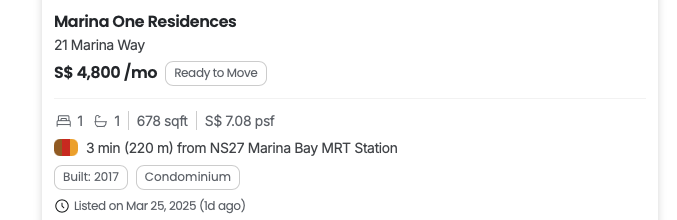

Marina One Residences One Bedroom for rent

A simple search on PropertyGuru would show that a 1 bedroom condominium at Marina One Residences is going for about $4,800 a month.

According to a recent Business Times article, the 1 bedroom units at One Marina Gardens starts at SGD$1.16 million.

Working out the yield based on an assumed rent of $4,800 a month or $57,600 per annum,

$57,600 / $1,160,000 = 4.97% per annum

Of course there are a few assumptions when it comes to my calculation. I am making the assumption that the 1 bedroom unit at One Marina Gardens can be rented out for $4,800 in about four years time. I believe my assumption is reasonable because it is likely that rents are likely to increase in the next four years, albeit at a much slower pace. The $4,800 is based off the current rent in an older development. Secondly, the purchase price is based on the lowest priced unit. However, if you factor in a higher purchase price, you would still receive a yield of more than 4%.

Ever heard the notion that yields tend to be lower in the city centre? Well not necessarily so. Especially when current property prices in the Outside Central Region (OCR) are so close to the prices in the Core Central Region (CCR) and Rest of Central Region (RCR). Try going to Chuan Park and getting a 1 bedder for less than SGD$1 million. I do not think it is possible. Then look at the prices at developments in areas that are so much closer to Singapore’s Central Business District (CBD).

Hence I firmly believe that if I were looking for a property with good rentability, One Marina Gardens is something I would look at.

The selling points of the development

Rentability and closeness to the MRT station and Singapore’s CBD. If location is the prime determinant of how much one should pay for a certain property, is the market making a mistake in looking away from developments in the Marina Bay Area?

Oh yes, heard of the Marina Bay Development Plan? The Greater Southern Waterfront?

If you require more information about developments in this area, you can refer to the URA website on The Marina Bay Story.

If you need more confirmation that there will be developments in the area, this is the URA Master Plan. The reddish pink areas where One Marina Gardens sits on are zoned Residential with Commercial at 1st storey. Those in white are White sites. It is clear that this is an area slated for future development. There will be HDB flats built in this area as well. It was announced in 2023 that more homes are planned in central locations to let more people enjoy city living. Marina South is one of those areas stated. With HDB flats in the vicinity, the usual amenities that are associated with HDB neighbourhoods are likely to also follow suit. Hence, if you do not have a food centre or supermarkets in the vicinity currently, if HDB flats are built here, then all these conveniences should make their way to this neighbourhood.

URA Master Plan

Possible bad points of the development

There is another plot of land slated for development right next to One Marina Gardens. This would block, perhaps partially, the sea view of units facing the sea. However, it is likely that there will be many new developments in the area so having an unblocked view would not be a permanent thing.

One Marina Gardens

Pricing 4/5

Prices start from $1.15 million or about SGD$2,762 psf. Yes you can get a Marina One Residences unit for $1,993 psf but then for some reason there is also an outlier that transacted at $2,522 psf. The average psf for transactions within the last 1 year is $2,112. Assuming an average price of about $2,900 psf, One Marina Gardens is going for a 37% premium over Marina One Residences. Of course you are getting a new lease and this is in an area with a lot of new developments. Hence you will need to factor this into the premium that you are paying.

Marina One Residences Past Transactions

Location 4.5/5

I believe this area is going to be filled with amenities as private developments as well as HDB developments start to fill the area. One Marina Gardens is the closest you can get to the Marina South MRT Station. The thing about the URA is that once it has announced developments in the area, it is most certainly going to happen. I believe in time to come this area is going to develop into an extremely desirable area.

If there were no ABSD on purchases beyond a Singaporean’s first property, I would seriously consider a property like One Marina Gardens.

Yours sincerely,

Daryl Lum

My other recent Singapore property reviews:

My review of Aurea by Far East Organization and Perennial Holdings

My review of Parktown Residence by CapitaLand, UOL and Singapore Land