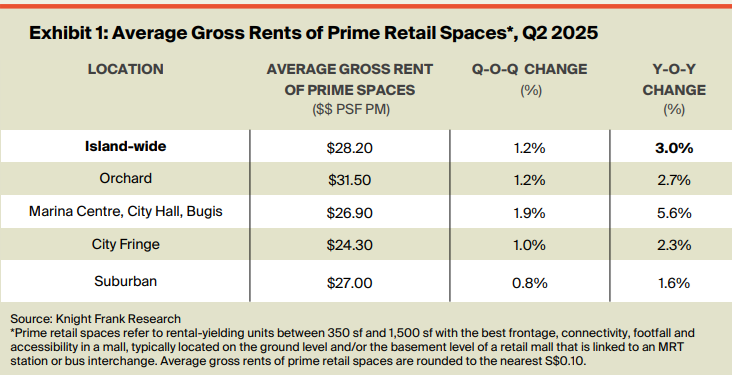

Singapore’s prime retail property sector continues to demonstrate remarkable strength, with average gross rents climbing 3% year-on-year. A new report from real estate consultancy Knight Frank reveals that the market is thriving despite broader economic pressures. The “Singapore Retail Market Update – Q2 2025” shows a consistent upward trend, giving investors and landlords reason for optimism.

According to the research, the average gross rent for prime retail spaces across the island now stands at S$28.20 per square foot per month. This figure also represents a healthy 1.2% increase compared to the previous quarter. For clarity, the report defines these prime units as spaces between 350 and 1,500 square feet that boast the best frontage, connectivity, and footfall within a mall. Typically, these are located on the ground or basement levels with direct links to MRT stations or bus interchanges, ensuring maximum consumer traffic. This sustained growth underscores the enduring appeal of premium physical retail locations.

City Centre Hotspots Lead the Charge in Rental Growth

While the island-wide average shows solid growth, a detailed look reveals that specific central locations are significantly outperforming the rest of the market. The area encompassing Marina Centre, City Hall, and Bugis reported the most substantial increase. Rents in this popular precinct surged by an impressive 5.6% since the same time last year, jumping 1.9% in the last quarter alone. The average gross rent here has now reached S$26.90 per square foot per month. This highlights strong demand for centrally located malls with a vibrant mix of office crowds, tourists, and local shoppers.

In contrast, suburban malls saw the most modest annual rental increase at just 0.8%, although their average rent remains competitive at S$27 per square foot.

31.50 per square foot per month, cementing its status as Singapore’s premier retail destination. This data provides clear insights for investors looking to target areas with the highest growth potential and rental yields.

A Look Ahead: Can a Supply Boom Stabilise Rising Rents?

The steady increase in gross rent, however, presents a significant challenge for tenants. Retail businesses, particularly in the food and beverage (F&B) sector, are already grappling with high operating expenses. The Knight Frank report notes that operating expenditures for F&B businesses have reached a record high of S$12.3 billion, and rising rents could further erode their margins. The resilience of these businesses will be a key factor to watch in the coming months. This dynamic underscores the delicate balance between landlord profitability and tenant sustainability.

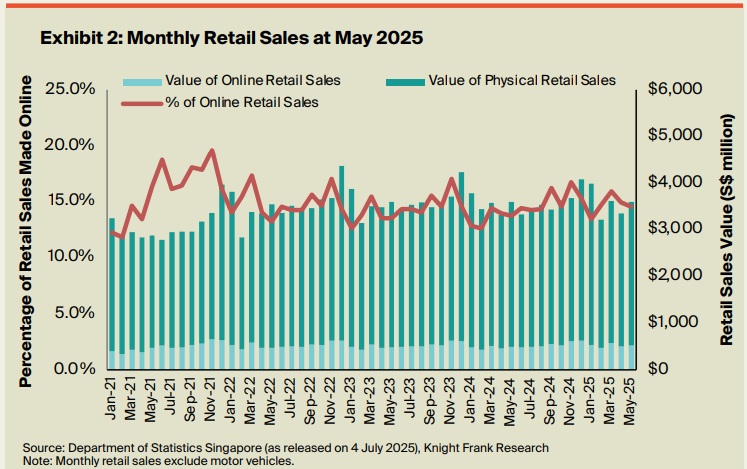

Fortunately, a silver lining appears on the horizon. The report projects that rental prices are likely to stabilize and potentially even decrease in the medium term. Between 2025 and 2029, a substantial 4.3 million square feet of new gross retail floor area is scheduled to enter the market. This significant increase in supply is expected to ease the upward pressure on rents, helping to normalize lease values and provide tenants with more options. For investors and developers, this signals a more competitive landscape ahead, while for businesses, it may offer much-needed relief. Despite the rise of e-commerce, this report reaffirms that physical retail remains a powerful force, contributing to over 85% of all retail sales in Singapore.

Source: The Daily Scan

0 Comments